The Shockingly Huge Cost of Only Making the Minimum Credit Card Payment

Credit cards are both a blessing and a curse.

A blessing if you can use them responsibly; a curse if you can’t.

A crazy 45% of millennials fall into the second category, since they only make the minimum payments on their cards, according to a National Endowment for Financial Education survey.

Only making the minimum payment? That might be the worst idea ever.

Everyone gets into tough spots — and if some emergency is barring you from paying off your card right now, I’m not talking to you.

But if you’re one of the 74% of millennials who claim you’re “good at dealing with day-to-day financial matters” — yet only pay the minimum so you can afford fancy cocktails or new jeans — it’s time to get your head out of the sand.

How Much Making the Minimum Payment Could Cost You

It can be tricky, because making the minimum payment seems smart.

You’re not getting hit with late fees, and your credit report isn’t getting dinged by late payments.

Good and good… but not good enough.

Making only the minimum payment on your credit card will cost you a LOT of money.

Just how much? Get ready to be shocked.

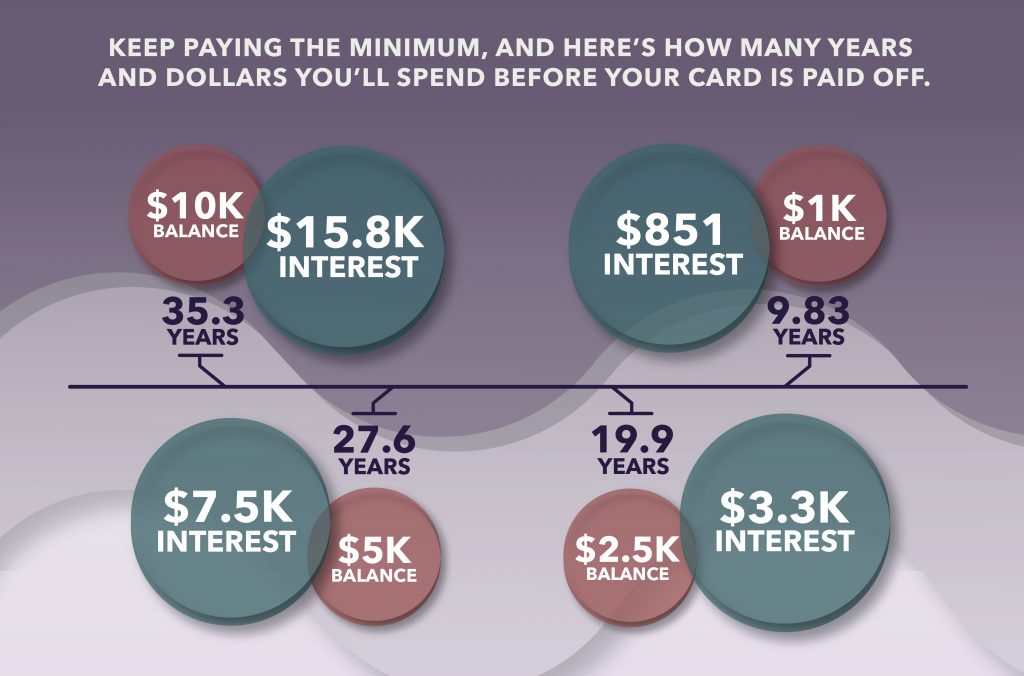

Using this credit card interest calculator from Bankrate, I plugged in some fairly typical numbers: an interest rate of 15% (which will be higher if you have poor credit), and a minimum payment equal to 2% of your balance.

$15,851 in interest on $10,000 in purchases?! Holy omg.

Unless you want to pay more in interest than you initially owed — and be a grandma by the time you finish — making more than the minimum payment is absolutely crucial.

How to Get Rid of Credit Card Debt

Since you’re now motivated to pay off your credit card debt, here are a few suggestions.

First, look at your card’s terms and conditions to determine your specific numbers, then plug them into the calculator. (You might wanna sit down first.)

Then, read these articles:

Lastly, stay committed.

If you need extra inspiration, just run the calculator again.

Think about how it’ll feel to get rid of high-interest debt — and also have some extra thousands of dollars in your pocket!

Your Turn: Are you surprised how much interest you can rack up with credit cards?

Susan Shain, senior writer for The Penny Hoarder, is always seeking adventure on a budget. Visit her blog at susanshain.com, or say hi on Twitter @susan_shain.