How Does Our Credit Card Debt Compare to the Rest of the World?

p>As a collective continent, our money is burning a proverbial hole in our pockets. Except, it’s not quite our money. It’s our credit cards. And maybe they’re not burning a hole in our pockets so much as they’re burning a hole in our credit scores. And maybe this old adage doesn’t aptly apply at all…

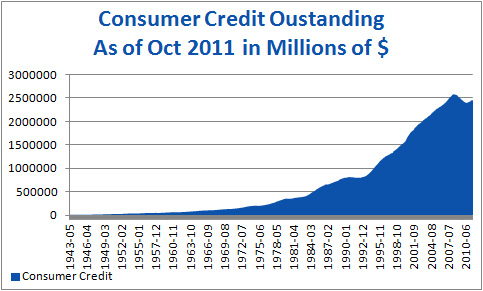

Perhaps it would just be better to say that North America has the most credit card debt than any other continent on the entire planet. The United States alone has $800 billion in credit card debt and the most credit cards reported per capita, with six of them for each person in the country. On a yearly basis, each of those people charges an average of $4,000 on their cards.

North of the border, these figures don’t get much better. Canadians may hold only half as many credit cards per person as Americans, but they definitely put theirs to use more often. The average Canadian consumer charges $7,400 to his or her credit cards each year.

While these numbers may seem shocking on their own, you don’t really get the full picture until you put them into context. Australia, though they charge even more than Canadians on their credit cards per year (nearly $7,900 on average), only hold one credit card each. And that’s really the only continent that can go head-to-head with us on spending.

Most other countries tend to be more cautious with their credit, opting instead to use debit cards (like in the UK and France) or online bank transfers (like in Germany) rather than to charge up a card. And when it comes to charges calculated per year, Europe makes us look like we spend with abandon; French people charge less than $300 each on their credit cards each year, on average. And Germans seem to eschew the “buy now, pay later” mentality as well, only charging an average of $158 per person per year to their credit cards.

But does charging your purchases to a credit card mean that you lack financial restraint? Not always. The primary reason cited for the overwhelming use of the credit card in North America was convenience. When consumers take into account that credit cards are considered a secure way to pay, no matter where you shop, it makes it easier for them to wield their purchasing power without worry. And, whereas cash is most times irretrievably lost when misplaced or stolen, a credit card can be easily replaced.

But we could learn a thing or two from how citizens of other nations manage their credit card use. The Chinese use theirs primarily for large purchases, and Australians use theirs for paying monthly bills. Using a credit card in this way is helpful because it makes it easier to know exactly what your balance is at all times. And if you limit your credit card usage to only specific areas of your budget, you’ll be more likely to pay off the balance within a certain amount of time, rather than become a revolver who is constantly working to chip away at not only the principal but also the interest charges.

Whether we North Americans are more likely to adapt a more conservative view on credit card spending or whether the rest of the world is destined to lean more toward our credit card behaviors remains to be seen. But one thing is certain: the amount that you charge to your card on a daily, monthly, or even yearly basis comes secondary to how you pay it off. When you spend big, and even when you spend small, fiscal planning and responsibility is the key.