This Mom Charges Her 5-Year-Old “Rent” — and the Internet Is Freaking Out

When it comes to teaching kids about money, many financial experts agree it’s good to start early.

But, with parenting approaches varying widely, it’s difficult to say exactly what a child should know about money and when.

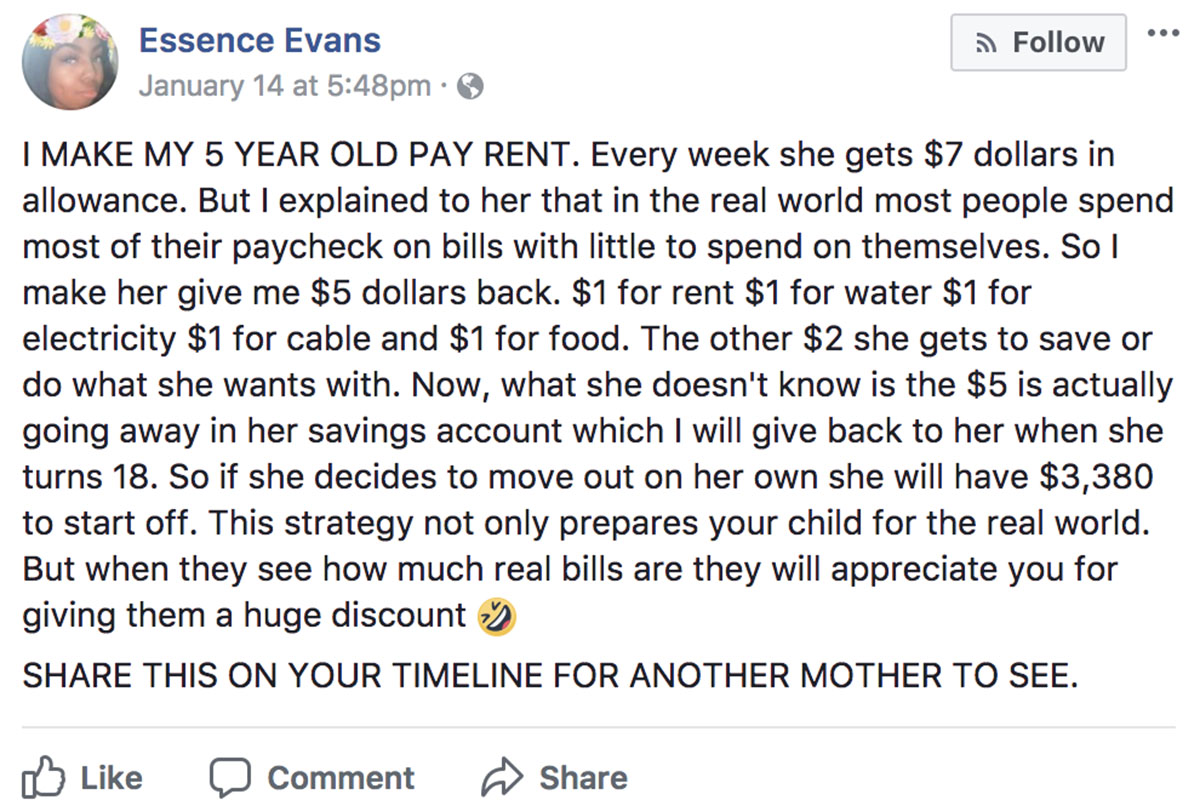

On Sunday, Essence Evans took to Facebook to share how she makes her 5-year-old daughter “pay rent.”

That’s right — pay rent, in addition to paying for utilities and food.

But before you get all upset, stick with me here. It’s not as extreme as you think.

Evans explains in her post that out of the $7 of weekly allowance she gives to her daughter, she makes her kid give $5 back — a dollar each for rent, water, electricity, cable and food.

That still leaves her daughter with $2 each week to save or spend however she’d like. Evans states she does this to explain to her daughter how “most people spend most of their paycheck on bills.”

Evans takes this approach on allowance as a teaching tool for her child. She isn’t actually collecting money from her young daughter to pay for a roof over her head or food on the table (because we all know that small amount wouldn’t even make a dent).

Evans said, unbeknownst to her child, she is setting that money aside in an account that her daughter can access when she turns 18.

I, for one, think it’s a pretty solid approach to teaching a child how to manage finances and allocate money for necessities. Often, children aren’t faced with the concept of paying bills until they have reached adulthood and have real bills with real consequences that’ll arise if they haven’t properly budgeted for them.

Plus, I subscribe to the school of thought that allowance is a privilege, not a right. This mom could easily have decided to just give her daughter a $2 weekly allowance (if any at all) and separately stashed $5 a week in a savings account for her child — bypassing the valuable financial management lesson.

But not all who’ve read Evans’ post share my opinion on the matter. Since Sunday, Evans’ post has garnered over 42,000 comments, more than 307,000 shares and over 219,000 likes and reactions. It has been discussed by various media outlets including Scary Mommy, Working Mother and Romper.

Many commenters have responded in opposition to Evans’ approach to teaching her daughter about personal finance, basically saying “let kids be kids.” Some say 5 years old is too young to know about household expenses, with other commenting that it’s “too much pressure” and will cause anxiety.

In addition, some readers say the weekly exercise will create a mindset of always being a slave to bill payments, while others nitpicked over other real-life expenses that weren’t factored into the equation.

At The Penny Hoarder, we’ve written about other out-of-the-box ways parents have taught their kids about money.

This dad wrote up contracts for his two daughters detailing the specific things they have to do to receive their allowance, with annual contract negotiations.

One businessman sent his teen away for a month with no phone, no connections, no place to stay and very little money — in an attempt to teach his son about hard work and the value of money.

Even celebrity chef Gordon Ramsay has shared how he refuses to leave his fortune to his four children in order to not spoil them.

Each family will inevitably be different when it comes to teaching kids about the important things in life. My hope is that money management is among those important life lessons parents will be sure to share with their children — in whatever form they choose.

Nicole Dow is a staff writer at The Penny Hoarder. She enjoys writing about parenting and money.