Want to Get Student Loan Debt-Free? This Free Chart Tells You How to Do It

Are you swimming in student loan debt — or drowning?

You’re not alone.

The average loan-holding college student graduating in 2016 owes a record-setting $37,172 in student loans, and the number is steadily climbing each year, the Wall Street Journal reported in May.

Many of us don’t even really understand the debt we’re in, until those monthly bills come knocking. Monthly payments can be upwards of $300… and why did anyone let 18-year-old me sign up for this?

If you’re stuck with confusing debt and an unfeasible repayment plan, this might help.

What is Student Loan Refinancing?

Refinancing would combine your various student loans, interest rates and payment plans into one new loan.

Depending on which rates you qualify for, this could help you get a lower monthly payment and interest rate, simplify your loan repayment and help you pay down your debt faster.

You’d be replacing some — or all — of your existing loans with a new private lender loan.

It also comes with new repayment terms, which give you a chance to start fresh with a new agreement and a potentially better interest rate to help you pay less in the long run.

Should You Refinance Your Student Loans?

Keep in mind that refinancing government loans with a private lender means giving up some borrower benefits, including access to income-driven repayment plans and the potential for loan forgiveness after 10, 20 or 25 years of payments.

But many borrowers decide the savings they can get through refinancing outweighs the value of those benefits.

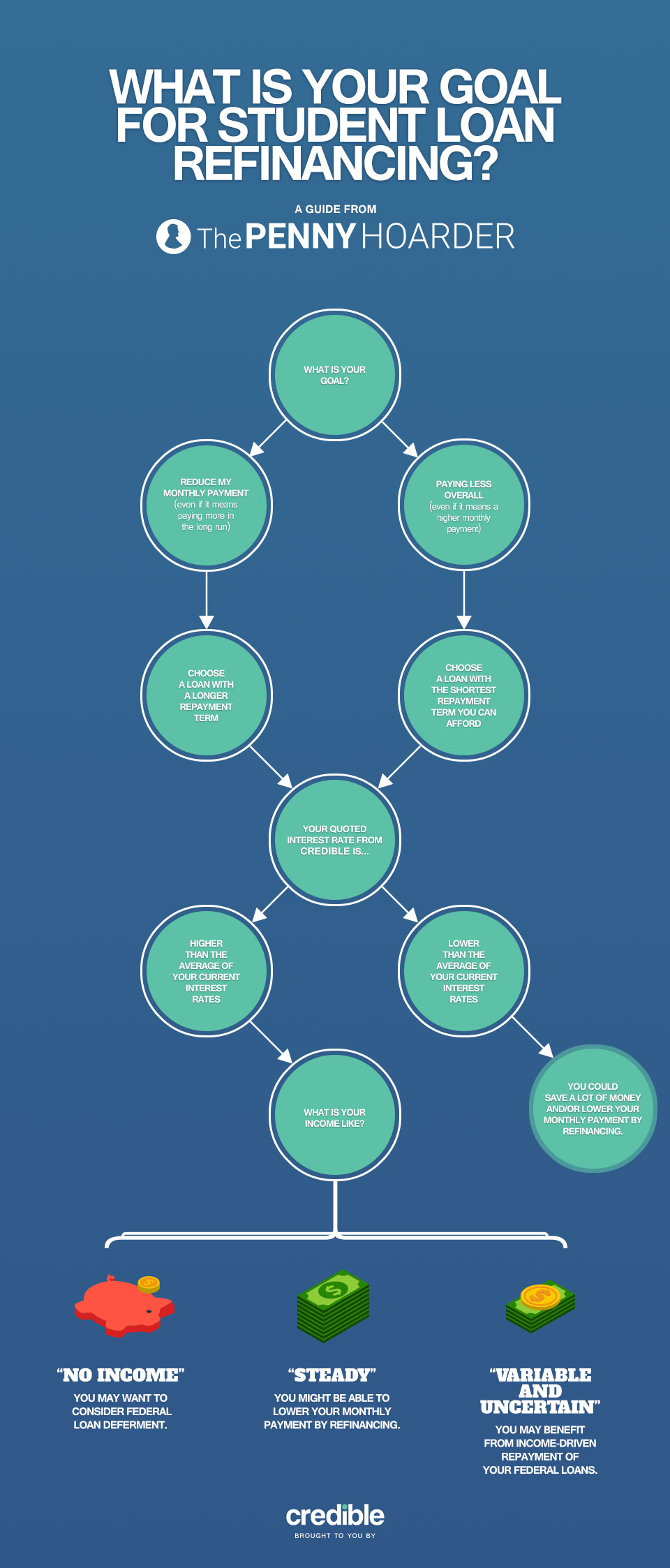

It can be a tough decision to make, so we created this handy chart to help you out!

See which options are available to you at Credible.com, a marketplace that lets you see personalized rates from multiple refinancing lenders. Seeing your offers on Credible won’t affect your credit score or share your information with lenders before you’re ready to proceed with an offer.

See your offers here, and answer the questions below to determine whether refinancing is right for you.

Your Turn: Will you consider refinancing your student loans?

Sponsorship Disclosure: A huge thanks to Credible for working with us to bring you this content. It’s rare that we have the opportunity to share something so awesome and get paid for it!

Dana Sitar (@danasitar) is a staff writer at The Penny Hoarder. She’s written for Huffington Post, Entrepreneur.com, Writer’s Digest and more, attempting humor wherever it’s allowed (and sometimes where it’s not).

Requesting prequalified rates on Credible is free and doesn’t affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.