The State of Savings in America

Everyone wants to save more money. But right now, it can feel like a real uphill battle. So we dug into American’s savings habits, struggles, and stress points in our recent State of Savings survey. You might be surprised at what we found.

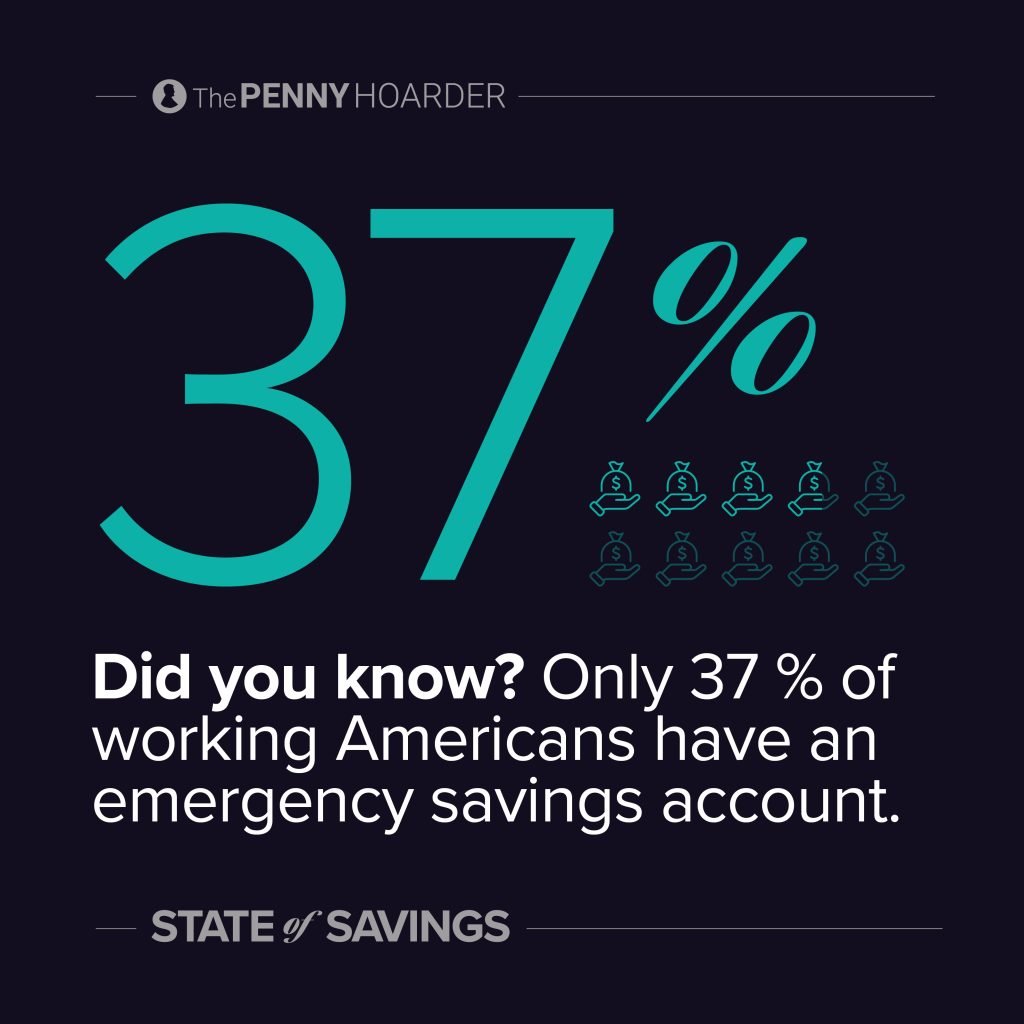

Only 37% of working Americans say they keep a dedicated emergency fund at all, and for those who do, a little more than half have $1,000 saved.

Emergency funds serve as crucial safety nets in case of an unexpected expense, and most experts recommend saving three to six months’ worth of expenses. When asked how much someone should have saved for emergencies, most people pointed to around $5,000, but few have that much set aside.

The survey, which asked 1,250 working Americans about savings, income, financial stressors and overall health of their finances, also found:

- 58% live paycheck to paycheck

- 33% lost significant income in the past year

- 35% say “not making enough money” is their biggest source of financial stress

- One in five don’t know how to handle financial setbacks or admit they don’t handle them well at all

The Savings Crisis

Most Americans genuinely do want to save money — more than two-thirds of our survey respondents say they learned good saving habits growing up.

The reality, however, is different.

According to our survey, 42% don’t have $1,000 in emergency savings and only 37% keep a dedicated emergency fund at all. About one-third of those with savings accounts have less than $500 saved while 5% have a negative balance in their savings account.

Meanwhile, 45% of people have completely drained their savings and 11% have drained it multiple times. And when it comes to retirement, one in five acknowledge their retirement accounts lag behind their peers.

So, why aren’t people saving?

- 42% of our respondents said “not enough income” is the biggest obstacle to saving

- 34% said “rising costs for everyday items” impedes their ability to put money back

- 38% said “more income” would help them save more effectively

The Paycheck-to-Paycheck Reality

Our survey shows most Americans are feeling financially pinched — 58% of respondents say they’re living paycheck to paycheck.

Forty-seven percent report needing more than one income to cover bills. Here’s how they’re making up the difference:

- 58% say that extra income comes from a spouse or partner

- 33% make extra money from a side hustle

- 20% say they’re getting help from another household member

- 11% get government assistance

An unexpected expense can wreck a budget, underlining the need for a dedicated emergency savings fund. But living paycheck to paycheck leaves little room to handle emergencies.

According to our survey, 55% of people had a significant unexpected expense last year. One-third lost significant income in the last 12 months.

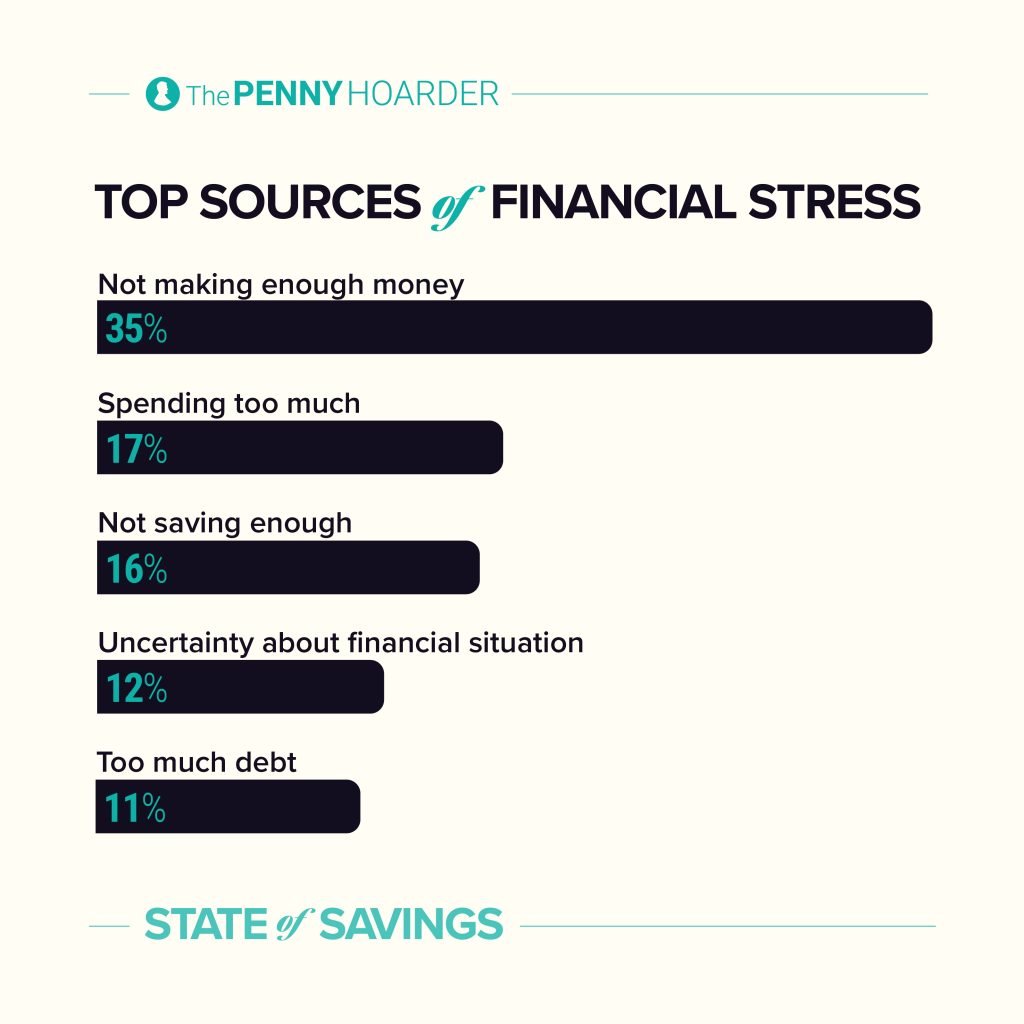

So, it’s no wonder finances are a significant stressor in Americans lives — 35% of our survey respondents said “not making enough money” is their biggest source of financial stress, followed by “spending too much” (17%); “not saving enough” (16%); “not being sure about my financial situation” (12%); and “too much debt” (11%).

How Cost of Living Factors In

This economy is tough, and it’s getting tougher as prices increase and wages show little to no growth.

Each household’s monthly expenses can vary greatly, but annual expenses can cost upwards of $85,000 a year. However, the median earnings for full-time and salary workers is only about $62,000 annually, the Bureau of Labor Statistics reported.

Here’s a look at some average household costs:

| Type of monthly expense | Monthly expense |

|---|---|

Mortgage/rent |

$2,067/$1,630 |

Childcare |

$1,100 |

Transportation |

$1,100 |

Health care premiums |

$1,514 per person |

Groceries |

$418 per person |

Utilities |

$600 |

Entertainment |

$303 |

The national average rent is sitting around $1,630, while the average mortgage payment is just under $2,100. The average cost of childcare in 2024 was $13,128 — about $1,100 a month, according to Child Care Aware of America.

In 2023, average transportation costs ran Americans $13,174 over the year, which comes out to about $1,100 a month. In 2023, out-of-pocket healthcare spending sat at $1,514 per person, per month. In 2024, groceries cost an average of $418 per month, per person. For entertainment, Americans were spending $303 a month in 2023.

The average utility bill cost Americans about $600 a month in 2024. That figure factors in electricity, gas, water, sewer, trash, internet, phone and streaming services. But home gas and electricity prices are climbing across the country — 11.7% and 5.1% higher, respectively, than a year ago.

In fact, most costs are increasing. We experienced a period of hyper-inflation during the COVID-19 pandemic and prices rose dramatically. Inflation began cooling toward the end of 2024 and beginning of 2025, but it started ticking up again by the second half of the year.

Spending and Saving Habits

How you spend and how you save are two of the biggest factors when it comes to financial health. Although most Americans aspire to save, inconsistent strategies are setting them back. For example, most of those who answered the survey do not put aside a set amount of money for savings each month. So rather than putting $200 a month in a savings account, whatever they don’t end up spending for the month is what they save. It’s harder to reach savings goals when you don’t have a plan in place.

However, many don’t know that this is a savings habit that could hurt them. Although 67% say they learned good saving habits growing up, good intentions don’t always match outcomes — reflected in the high rates of drained savings accounts. Here’s how they play out in practice:

- 48% only save what’s left after bills.

- 27% save a fixed amount.

- 11% have no strategy.

- 9% spend all disposable income.

Saving is still a priority for many, however. If given $1,000, 67% would save, 19% would invest, 10.6% would spend it and 3.2% would put it toward a side hustle.

That’s why we launched Project Piggy Bank, a savings initiative from The Penny Hoarder designed to help everyday Americans build stronger financial habits and give one lucky saver a $1,000 head start. Enter to Win $1,000 to Kickstart Your Savings.

Also, an overwhelming majority (71%) save for big purchases instead of putting them on a credit card, but 29% still lean on credit. The latter can quickly spiral into debt and create more financial setbacks.

Types of Savings Accounts

Saving in general is helpful, but some accounts are better for reaching certain goals than others. Most of those we surveyed have some form of a savings account, but 13% don’t have one at all. That can seriously stunt financial goals.

Among those who do have them:

- 70% have a generic savings accounts (a place to set aside extra money with no specific purpose)

- 37% have an emergency fund (that’s used specifically for unexpected expenses like medical bills and car repairs)

- 24% have a goal-based savings account (money they’re saving for a vacation, a down payment on a home, wedding, etc.)

- 41% have a retirement savings account (like a 401(k), IRA or personal account)

How Respondents Get Money Quickly

Emergencies happen whether or not someone has the means to deal with them. To assess how people acquire emergency funds, we asked what people would do if they needed money fast. Most said they would either back off on spending or sell something they didn’t need anymore. However, others said they would borrow from loved ones or take out a loan. Here’s the breakdown:

- 30% said they’d tighten up their spending to free up extra cash

- 21% said they’d sell something they don’t need

- 19% said they’d pick up a side hustle

- 13% said they’d liquidate savings or leverage an investment

- 12% said they’d borrow from friends and family

- 4% said they’d get a quick loan from lending institution

Credit Health Snapshot

Credit can heavily affect the overall health of finances. Lenders use credit scores to help decide whether to loan you money. Your score can determine whether you qualify for a mortgage, loans and credit card, as well as the terms and interest rates. Landlords may even accept or deny a rental application because of a credit score.

Americans are generally optimistic about their credit health. But nearly 1 in 10 don’t know or haven’t checked, so there is a blind spot.

- 40% say their credit is better than average; 33% average; 18% below average

- 73% checked their score in the past year, while 27% did not

- About 9% are in the dark (don’t know or never checked)

Most of the people who responded to the survey define a “good” credit score as 710, which is on par with the major credit bureaus.

Next Steps in the State of Savings

Many Americans are struggling not only to save, but to also keep up with regular bills. Without enough money saved to put toward an emergency, more than half of the Americans we surveyed are in an extremely financially vulnerable position.

We know most Americans want to save. But living paycheck to paycheck is making it feel impossible. But finding ways to save toward a goal – like $1,000 – can start small. Automatically depositing even a few dollars in a high-yield savings account can be an easy way to “set it and forget it.”

If you’re looking for ways to build savings faster, taking on a side hustle could be an option. Once you have an emergency fund established, you could even consider investing a little to earn some passive income so you can breathe easier knowing you’ll have money now and in the future to cover an emergency.