The Tax-Time Reality Check: More Than Half of Americans Depend on Tax Refunds for Basic Expenses

For many Americans, a tax refund isn’t a windfall or splurge money — it’s a critical lifeline for covering essential expenses.

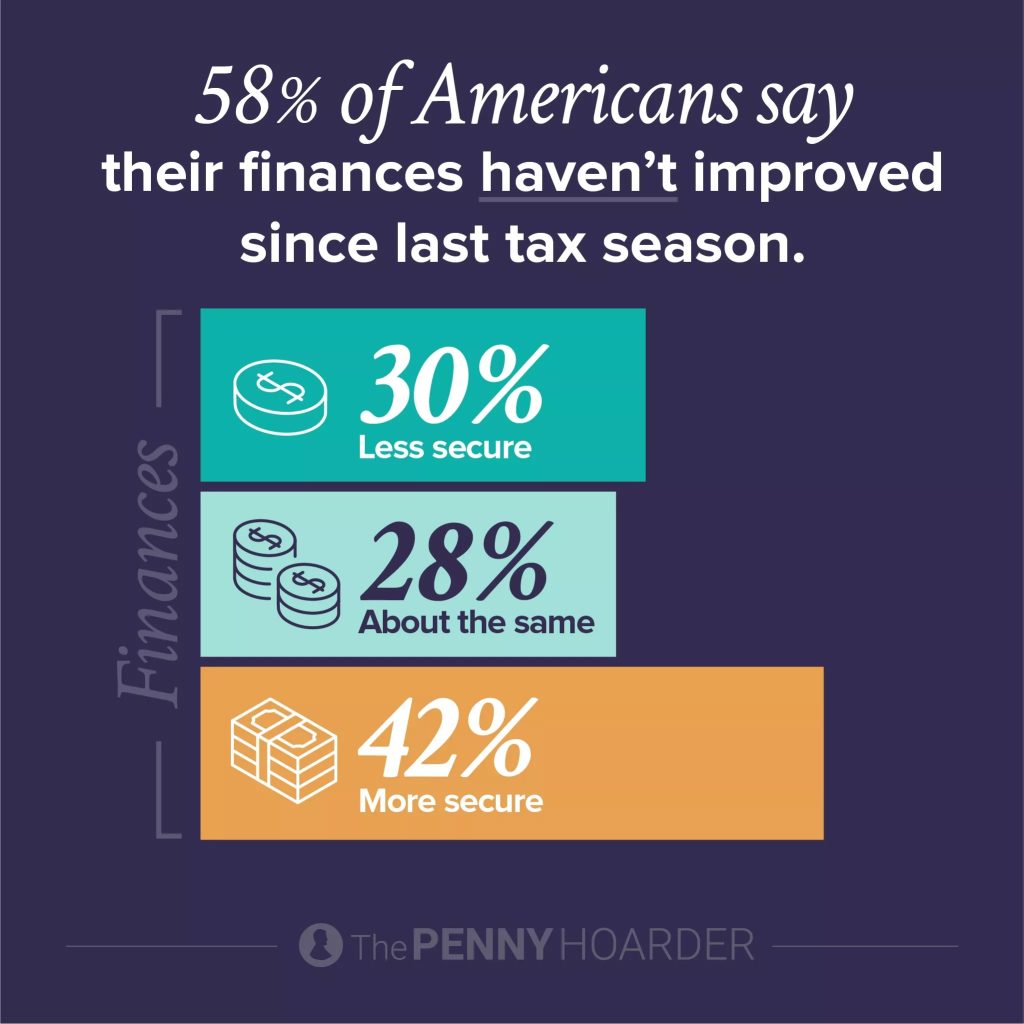

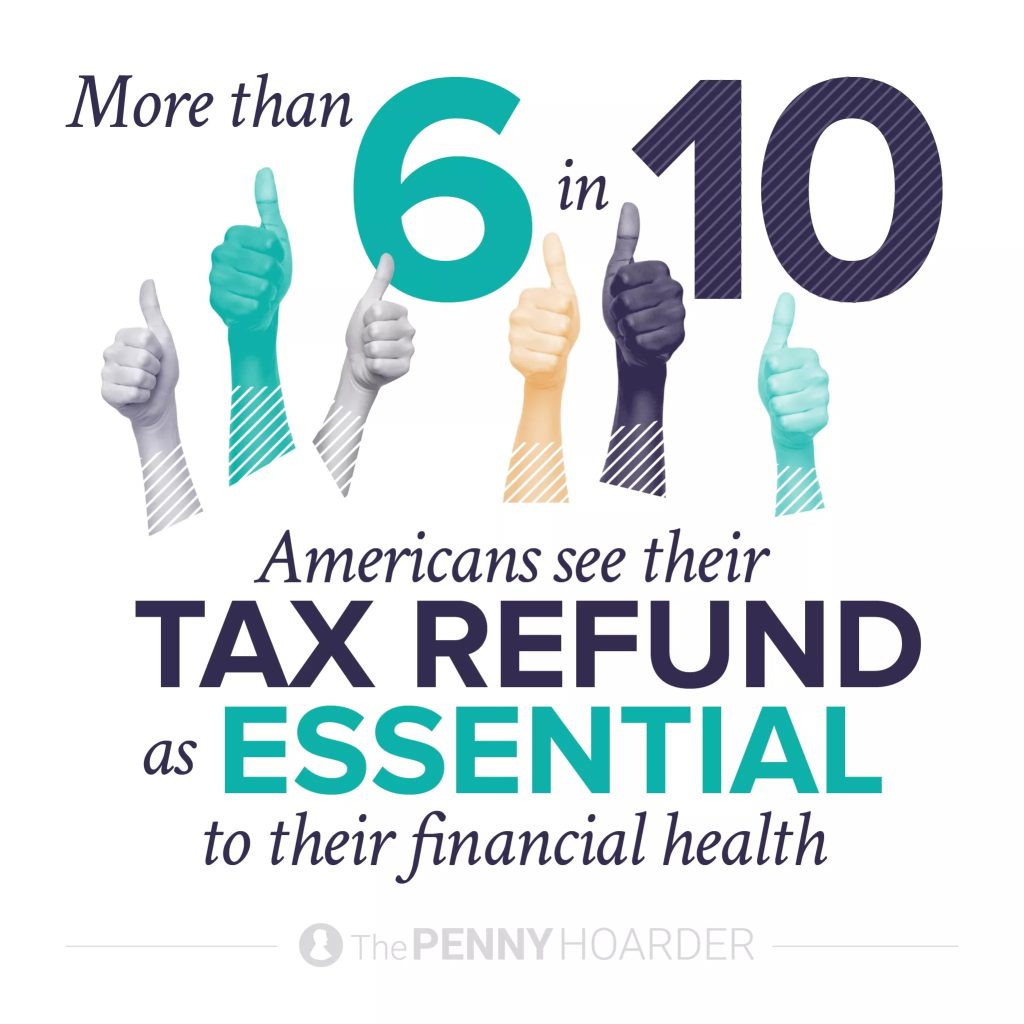

In fact, nearly 6 in 10 Americans view their tax refund as essential to their financial health — not discretionary spending — according to a new Tax-Time Reality Check survey from The Penny Hoarder. Further, 58% of respondents said their financial situation hasn’t improved since last tax season.

Conducted in January 2026, the survey asked 1,000 U.S. adults from the general population who plan to file a federal income tax return this year about financial pressures, filing habits and why tax refunds matter more than ever.

Why Tax Refunds Are No Longer Optional For Many

Most financial experts will tell you a large tax refund is a sign you’re withholding too much from your paycheck and you’re just giving an interest-free loan to the government.

Instead, you should withhold less and put that money somewhere it can grow for you — like a high-yield savings account. When the tax bill comes due, you’ll pay with the money you’ve been saving and keep the extra interest you made on the money over the course of a year.

That’s all great, in theory. But the reality for many of us is that any extra money in our paychecks would get eaten up by bills, higher prices and unexpected expenses. We’d end up with no tax refund and a tax bill we can’t afford.

Survey respondents echoed this, highlighting the reality that a tax refund is more like an annual financial infusion that keeps them afloat. In fact, 64% of Americans say a smaller-than-expected refund would negatively affect their finances, and 1 in 5 say a smaller-than-expected tax refund would cause severe financial hardship.

Because prices for everyday expenses are still high, most Americans plan to use their tax refund to stabilize their finances, according to our survey. Large shares of taxpayers plan to use their refunds to cover essential living expenses (37%), catch up on overdue bills (38%) or rebuild savings (43%).

This also means the refund money can’t come fast enough for some; 22% of Americans have used a refund advance or refund anticipation loan to access their refund early. Most experts caution against these options because the interest charges for these loans can be exorbitant. But again, for some, that may be the only option when money is tight.

The good news is, most Americans expect to receive a tax refund this year, while about 1 in 10 expect to owe money and another 1 in 10 are unsure.

Why Taxes Stress Us Out

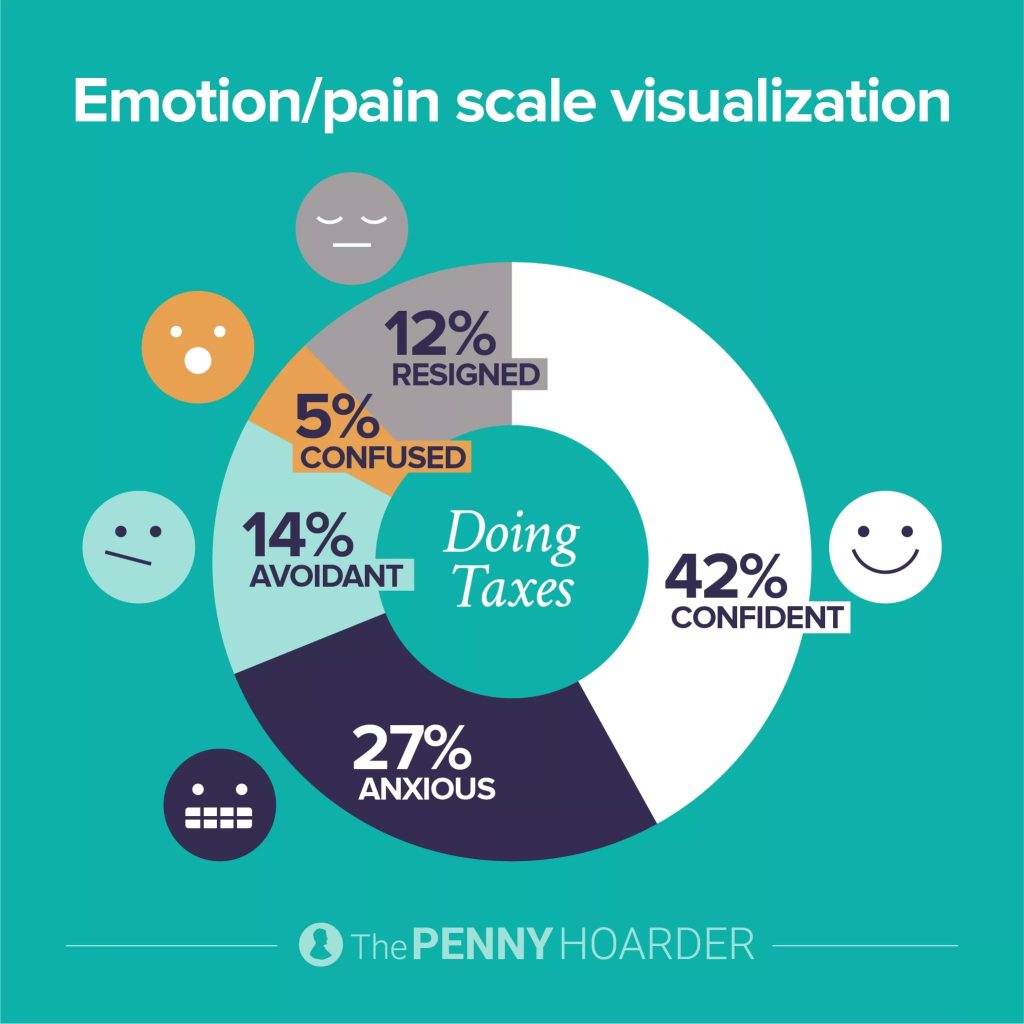

Although a tax refund is essential for many Americans’ finances, filing taxes is still stressful, our survey found. Most Americans do not feel confident heading into tax season, with one in four feeling anxious and another quarter procrastinating or confused.

The biggest sources of tax season stress are owing money, fear of making a mistake and the hassle of gathering documents:

- Fear of making a mistake (27%)

- Owing money (26%)

- Gathering documents (14%)

To help reduce your stress over taxes, we recommend collecting necessary documents well ahead of the April 15 tax deadline, understanding the basics about how to file taxes and turning to a tax professional for advice on your specific tax situation. It’s also important to note that procrastinating too long on your taxes gives scammers more time to steal your tax-related identity info.

How Non-Traditional Income Complicates Taxes

Most Americans who plan to file a federal income tax return this year get at least some of their income from a “regular” job — aka a W-2 job. Our survey found that more than two-thirds (70%) of workers earn income from one. However, the growth of side hustles in recent years means not everyone gets all their money this way.

In fact, nearly three in ten Americans earn income outside of a traditional W-2 job, and more than one in five rely on side hustles or supplemental income (22%). Even more workers are earning from self-employment, freelance and gig work (27%). This can all add a layer of complexity to tax filing.

That’s because with a W-2 job, the employer withholds taxes from people’s paychecks and pays it to the IRS on the employee’s behalf. If you earned money from sources like contract work or freelancing, you’re responsible for making sure those taxes get paid, including the employer’s share of taxes for things like Social Security and Medicare, plus self-employment taxes.

There are even more sources of income to consider outside of W-2 jobs, self-employment and side hustles. Survey respondents said they also earn money from investments (23%) and retirement earnings (14%).

- Investments (23%)

- Retirement (14%)

Respondents said they also received income affected by changes in the tax law this year, including tips (9%) and tax-exempt overtime pay (10%). We’ll get into that in a bit.

Only 2% of our survey respondents say they make no taxable income at all. Sources like child support and (most) alimony payments tend to fall into this category. Anything considered taxable must be reported, which is why it’s important to research filing rules around all sources of income or consult a tax professional.

Is Filing Yourself a Smart Move or Frugality Fail?

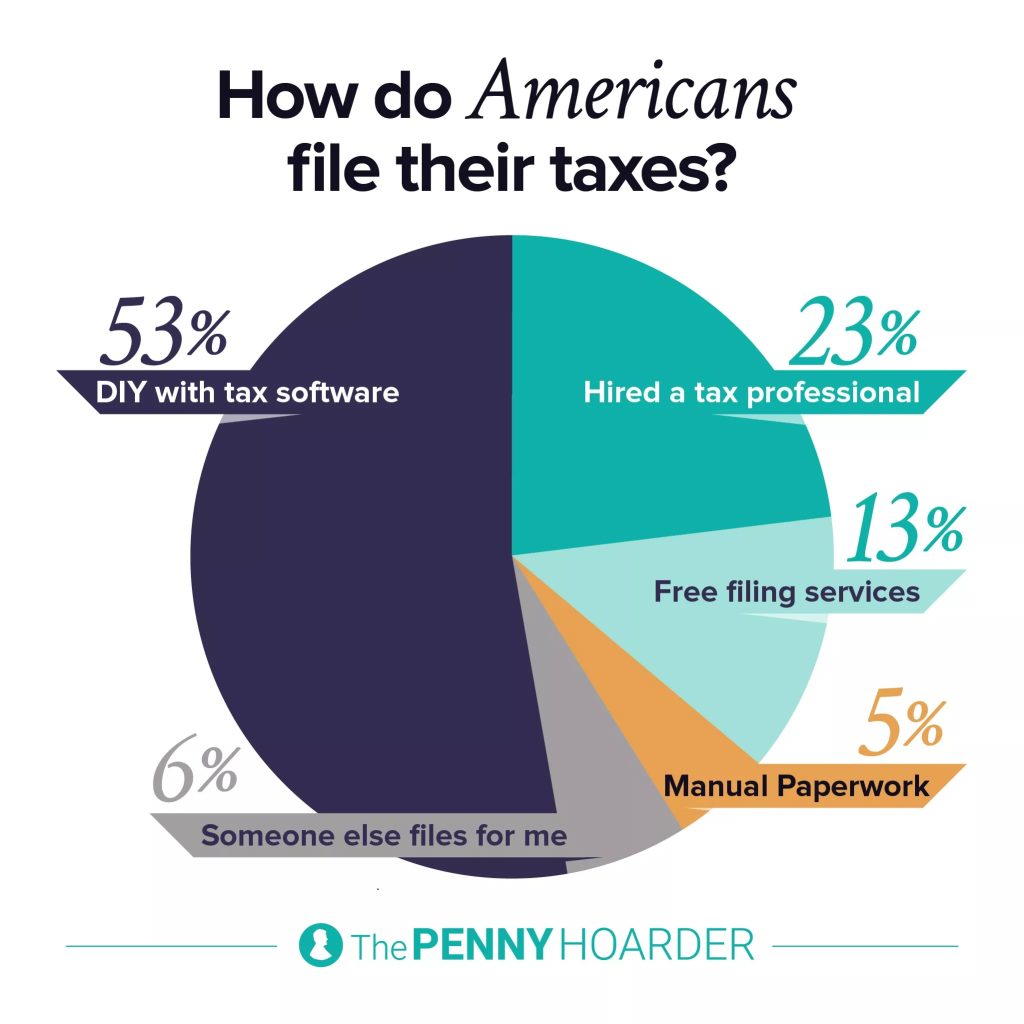

Having a professional prepare your taxes can take some stress off of you, but it can cost hundreds of dollars (or more), depending on your return’s complexity. It’s a cost most Americans either don’t want to or can’t pay. More than half of survey respondents said they file their taxes themselves using tax software rather than pay someone else to do them.

This cost-saving measure saves on a fee in the short term. However, making a mistake could prove even more expensive in the end than paying a professional. This is a risk a lot of taxpayers take.

About three-quarters of Americans (74%) say they understand how taxes work for their personal situation at least fairly well — but roughly one in four admit they only understand the basics or find taxes confusing. Figuring it all out on their own takes time, too. Between gathering documents and filing, Americans spend roughly three hours actively preparing their taxes each year.

The increase in side hustles and multiple income streams makes taxes more complicated for more Americans. But most still prepare and file their taxes on their own using software rather than professional help.

- Fewer than one in four rely on a paid tax professional.

- Only about one in eight use free filing services.

If you’re stressed or confused about certain concepts in your taxes — or you simply don’t have the time — it might be worth looking into finding a professional who fits your budget. If you qualify, there are many free tax filing options that will answer your questions throughout the process.

AI as Your Tax Adviser

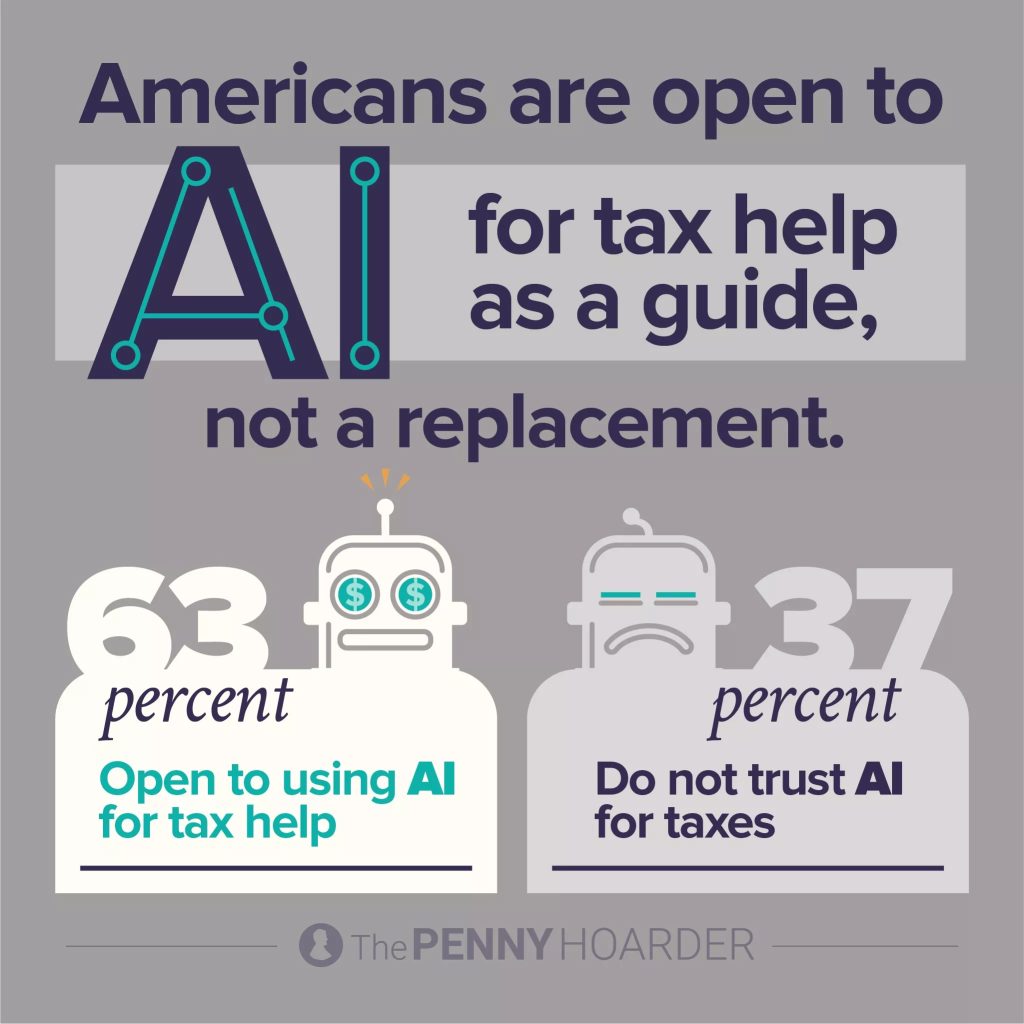

People are turning to AI for just about everything these days, even taxes. In fact, nearly two-thirds — 63% — of Americans are open to using AI for tax help while 37% say they don’t trust AI for taxes.

We fall into the latter camp. AI can be a useful tool, and tax software and filing services likely use proprietary AI, but asking a chat bot to do your taxes is risky. Any information you give to a public large language model platform (like ChatGPT) may be stored, analyzed or reviewed. So if you ask AI to prepare your return, things like your W2, total annual income and your Social Security number may be put at risk. Additionally, public AI chatbots may not be properly trained to accurately interpret complicated tax laws, including state and local rules, that may change annually.

Americans are most comfortable using AI as a second set of eyes or an educational tool. Our survey results showed:

- 25% would use AI to double-check their work

- 22% would use it to explain tax jargon

- 20% would use it to save money on professional fees

- 12% would use it to find “hidden” deductions

- 21% say they wouldn’t use AI for taxes at all

Things To Remember When You’re Filing

Tax time can be confusing for many of us, especially when it comes to deductions to reduce our tax bill. Although two-thirds of Americans take the standard deduction, one in eight say they aren’t confident they’re claiming all the deductions they qualify for.

Tax deductions, also known as tax write-offs, lower your taxable income so you’ll pay less overall. Some new deductions come from the One Big Beautiful Bill Act, which passed last year. Notably, the bill introduced two attractive tax deductions for tipped workers and employees eligible for overtime:

- Deductions for tips: Employees and self-employed individuals may deduct the first $25,000 of tipped wages for qualified jobs, including wait staff, bartenders, salon workers and personal trainers. Married couples who file together and both receive tips can claim the deduction for each filer; those who are married filing separately are not eligible. Nine percent of our survey respondents say they earn income from tips.

- Deductions for overtime: Eligible single filers can deduct up to $12,500 in overtime wages. Married couples filing jointly can deduct up to $25,000. According to our survey, 10% of people earn from tax-exempt overtime pay.

There are also new deductions for seniors and for those who financed a new car last year.

- Deductions for car loan interest: The deduction applies to new made-in-America vehicles purchased after Dec. 31, 2024. This deduction is for those who make less than $100,000 in gross income, $200,000 for joint filers, and is applicable whether you use the standard deduction or itemize deductions. It has a maximum $10,000 deduction and expires in 2028.

- Deductions for seniors: Those over 65 can claim an additional deduction of $6,000, $12,000 for married couples so long as they’re both 65 and make less than $75,000 each in gross income. This deduction also expires in 2028.

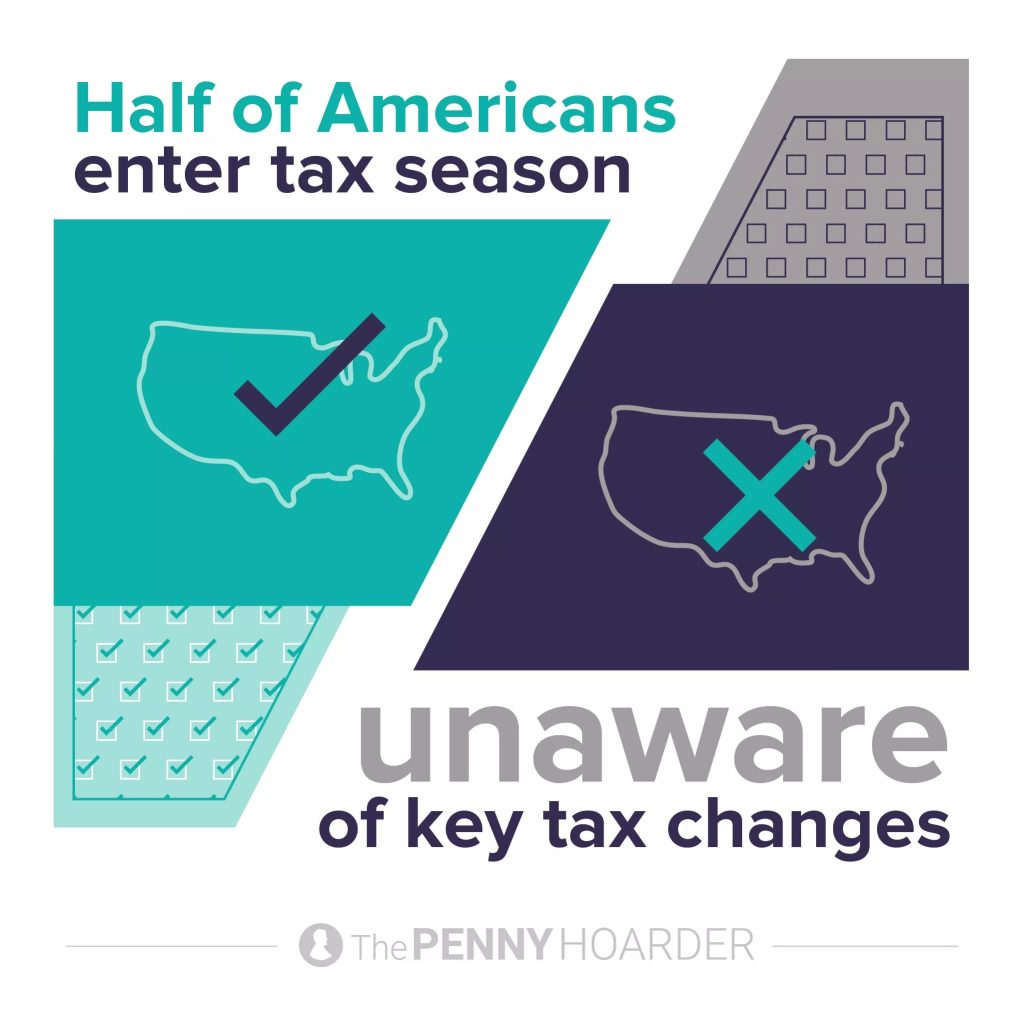

Only about half of Americans say they’re aware of new tax changes that could affect their filing this year. That means many taxpayers are heading into tax season without knowing if key tax changes apply to them.

- 52% say they’re aware of tax changes related to recent legislation

- 56% are aware of changes affecting tips or gratuities

- 53% are aware of changes to overtime pay

- 33% are aware of new deductions for seniors — meaning two-thirds are not

- 50% say they understand how their own tax situation has changed

In addition to understanding deductions available to you, there are a few things you should know before filing.

- There are many tools you can use to file your taxes, including tax software. Some are free and best suited for basic filers. Others can cost up to hundreds of dollars, depending on the complexity of your tax situation. Here’s our roundup of the best options out there.

- Some income is taxable and some isn’t. For instance, things like your salary, tips, gambling winnings and hobby income, among others, are all taxable. Meanwhile, crowdsourced money, child support, alimony and disaster relief aren’t. Understand how your income is classified by using our guide on taxable income.

- If you work from home, you may be able to deduct your home office, but only under certain circumstances. Here’s the rundown.

- Do you freelance? Or work for yourself? Your taxes are going to be a little different. Here’s how to navigate independent contractor taxes.

- Once you’ve filed, you should start thinking ahead about taxes next year. Here are the tax brackets for 2026 and our list of ways to keep more money in your pocket at tax time.

What if You Owe?

Last year, the IRS processed nearly 166 million returns and issued nearly 104 million refunds, according to the agency’s 2025 tax statistics. The average refund was $3,167. Because of the One Big Beautiful Bill, that’s expected to be higher this year.

Still, many people owe the government money in taxes — one in 10 Americans say they expect to owe money and another one in 10 are unsure, according to our survey results.

Should they owe, nearly half of our survey respondents say they would dip into savings to pay a tax bill, while many would rely on payment plans or credit cards to cover the cost:

- 48% say they’d use savings to cover their taxes

- 28% say they’d set up a payment plan with the IRS

- 25% say they’d use a credit card, according to our survey

If you have an unexpected bill, here are eight options for paying it.

Tiffany Wendeln Connors is senior managing editor of The Penny Hoarder. Katie Sartoris is managing editor. Mackenzie Raetz is senior editor of freelance.

Methodology

This survey was conducted by The Penny Hoarder using Pollfish in January 2026. The survey included 1,000 U.S. adults from the general population who plan to file a federal income tax return this year. All results are post-stratified to reflect the U.S. adult population, ensuring the findings are nationally representative. Percentages may not total 100% due to rounding or because some questions allowed multiple responses.