Rocket Money Review: Is It Worth the Cost for Budgeting & Subscription Tracking?

If you want to turbo charge your savings but don’t want to get bogged down by the details, we may have the budgeting app for you. Rocket Money (formerly Truebill) is a personal finance app designed to help users manage spending, cut unnecessary subscriptions and save automatically. It can even negotiate your bills for you, although it takes a cut of the savings.

Rocket Money is all about weeding out what you may be wasting money on unnecessarily: Think subscriptions and recurring charges. Its automated features can save you money and time spent haggling over bills. The company says it’s saved users more than $2.5 billion* since it was founded in 2016. We’ll check out the features, pricing and safety for the app in our Rocket Money review. Then we’ll get into the pros and cons of Rocket Money and see how it stacks up against other budgeting apps like Cleo and YNAB.

What Is Rocket Money?

Rocket Money is a personal finance app that links to your bank accounts, credit cards and investment accounts to help you track spending, manage subscriptions and build savings.

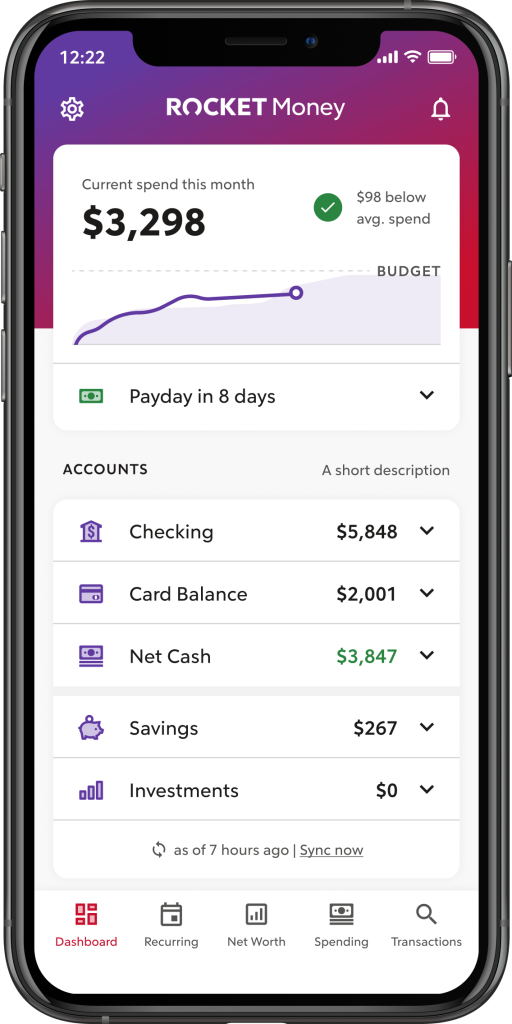

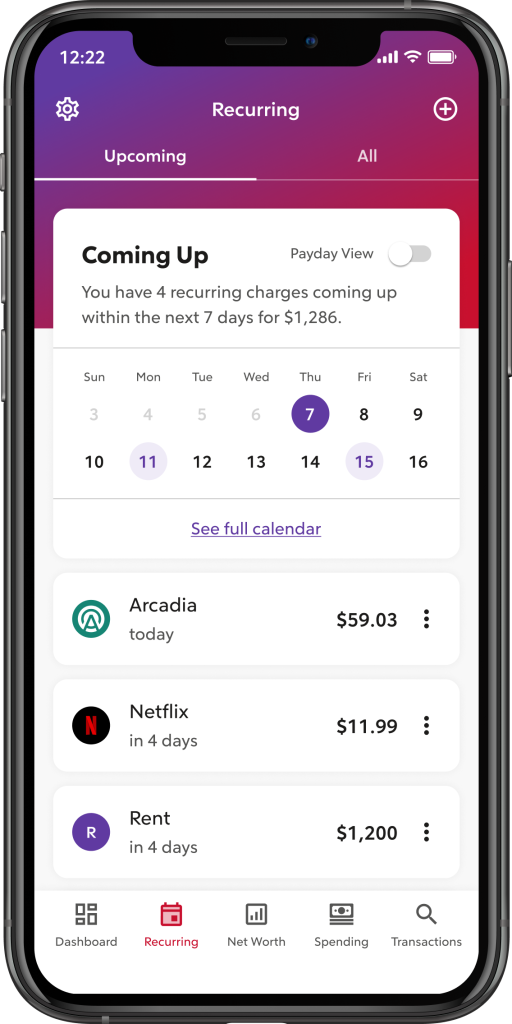

When you download the app, you’ll be taken to a dashboard, which offers a clean, simple display of your accounts, upcoming bills, recent transactions and other insights. If you pay for the premium service (which is heavily advertised in-app), you can also have Rocket Money do the heavy lifting of canceling subscriptions and services for you.

How Rocket Money Works

Rocket Money works by linking your financial accounts and automatically analyzing transactions to surface spending patterns and recurring charges. It tracks spending by securely linking to bank accounts and credit cards and importing transactions automatically.

Once accounts are connected, the app categorizes spending into buckets like groceries, rent, dining and subscriptions. Users can rename or recategorize transactions, but most of the process is automated, which appeals to people who want quick insights rather than detailed manual budgeting. There are also even more features that come with premium pricing, which we’ll go over later.

Rocket Money Pricing & Plans

Rocket Money has a free version, and it lets you pick how much you’ll pay, from $7 to $14 a month, for its premium version. Why would you ever choose more than the minimum when every user gets the same features? The company says it’s to let you decide how much value you’re getting from the service.

Free vs. Premium plan

The premium version includes all the basic features as well as the following:

- Smart savings

- Net worth tracker

- Credit score monitoring

- Unlimited custom budget categories

- Canceling subscriptions on your behalf

You can use a free version of Rocket Money that includes account linking, balance alerts, subscription management, spend tracking and two custom budget categories. Rocket Money offers a free seven-day trial of its paid version, so you can see for yourself if you think it’s worth it.

How much Rocket Money actually costs

Rocket Money Premium uses a pay-what-you-want pricing model, typically ranging from $7-$14 per month.

Users choose their monthly fee within the allowed range, and pricing may change over time. This flexibility can make the app more accessible, but it also means costs aren’t always clear upfront unless you explore the settings.

When paying may be worth it

Paying for Rocket Money may be worth it if you have multiple subscriptions or negotiable bills that you don’t want to manage manually.

If you primarily want spending awareness and don’t mind canceling services yourself, the free version may be enough. The Premium plan makes the most sense when automation saves you time or helps offset its own cost through reduced bills.

Is Rocket Money Worth It?

If you’re new to budgeting and not sure where to start, Rocket Money is a good starting point. It’s easy to use and is helpful for automatically tracking expenses. The premium version is good for busy people and those who may forget about recurring bills and subscriptions, since you can pay them to negotiate your bills and cancel subscriptions.

If you’re more of a Type A budgeter who likes to track the details of every transaction, Rocket Money may not be a great fit for you.

Key Features Explained

There are plenty of helpful features you’ll get with the Rocket Money app, although most are only available with a “premium” paid subscription:

- Financial Goals: You can set savings goals and schedule regular automatic transfers. Financial Goals is held by an FDIC-insured partner bank, so your money is safe up to $250,000 per member. With Smart Savings autopilot, Rocket Money analyzes your checking account balance and spending patterns to automatically transfer small amounts every 1-3 business days, building your emergency fund, vacation savings, or down payment without you lifting a finger. It’s like having a personal savings assistant that knows exactly when you can afford to save. If you prefer to have more control, Custom Savings lets you set specific deposit amounts and frequencies to match your savings timeline. Whether you’re saving $1,000 for a summer trip or building long-term wealth, you decide how much and how often to save.

- Net worth tracker: Premium feature that gives you a high-level view of your finances by tracking your assets vs. debts.

- Credit score monitoring: Premium feature that gives you access to your credit report and alerts you of events that could impact your score.

Rocket Money’s features focus on automation and visibility rather than granular budget control.

Budgeting tools

Rocket Money’s budgeting tools track spending and create categories that quickly show where your money goes.

Users can set monthly spending limits by category and see progress throughout the month. This works well for awareness but may feel limited compared to apps built specifically for zero-based or envelope budgeting.

Subscription cancellation

Automatic subscription tracking detects recurring charges by analyzing transactions from your bank and credit card accounts. With the premium version, you can view them in the “Recurring” tab and cancel them.

Bill negotiation

Rocket Money’s team can negotiate lower bills for internet, phone or cable. This service is available to all users, both free and Premium, but there is a fee involved. All users pay a fee of 35%-60% of the first year’s savings, only if the negotiation is successful.

While the service does save you the hassle of negotiating, we’d recommend reaching out to the provider yourself to avoid paying the extra fee, especially since some “savings” Rocket Money negotiates are promotional deals that may expire.

Smart savings

Rocket Money’s smart savings tools help users set aside money gradually based on spending patterns.

These features are designed to be low-effort, though they’re less customizable than standalone savings apps. For some users, the automation helps build consistency without active management.

Pros and Cons of Rocket Money

Pros

- Easy-to-use interface

- Helpful alerts and subscription detection

- Option to automate savings

- Potential savings from bill negotiation

- Flexible premium pricing

Cons

- Limited budgeting customization

- Premium features locked behind paywall

- Sliding scale for premium can feel unclear

- Bill negotiation fee could offset some savings

- Not ideal for detail-oriented budgeters (like YNAB users)

Rocket Money vs Other Budgeting Apps

Other apps at a glance:

| Feature | Rocket Money | Cleo | YNAB |

|---|---|---|---|

Subscription tracking |

Yes |

No |

No |

Budget customization |

Moderate |

No |

Yes |

Bill negotiation |

Yes |

No |

No |

Free version |

Yes |

Yes |

No |

Gamified or AI chat |

No |

Yes |

No |

Credit score tracking |

With premium |

With premium |

No |

Rocket Money’s strength is its automation and budgeting features but isn’t great for personal engagement. In contrast, Cleo focuses on engaging users and YNAB offers full control for detail-oriented budgets. This is a more detailed look at how these other budgeting apps compare.

Who Rocket Money Is Best For (and Who Should Skip It)

Rocket Money is best for people who want a low-effort way to manage subscriptions and recurring expenses.

It works well for users with multiple monthly charges, those who dislike spreadsheets, and anyone who wants automation over precision. On the other hand, people who prefer detailed budgeting systems or already track expenses closely may find limited added value.

Is Rocket Money Safe?

Rocket Money uses bank-level encryption and secure third-party integrations (via Plaid). The app has read-only access to financial accounts, meaning it can’t move money from one account to another without your approval.

Rocket Money is owned by Rocket Companies, Inc., a publicly traded company. According to the company, more than 10 millions people use the app, and it has strong reviews in the Apple Store and on Google Play.

FAQs About Rocket Money

Rocket Money Premium uses a pay-what-you-want model, typically within a monthly range set by the app (expect $7-$14). The free version offers basic tracking, while most automation features require Premium.

Rocket Money has a free plan, but many of its most useful tools are locked behind the paid version. Users can still track spending and view subscriptions without paying.

Rocket Money can help save money by identifying unused subscriptions and negotiating certain bills, but results vary. Savings depend on your existing expenses and which services are eligible.

If Rocket Money can’t lower a bill, you typically don’t pay a negotiation fee. The app only takes a percentage when savings are successfully secured.

Yes. Smart Savings lets you set goals and automatically transfer small amounts into savings.

Rocket Money is a legitimate budgeting app used by millions of people. It uses secure connections and read-only access to linked accounts, though no app can guarantee zero risk.

Final Verdict

Rocket Money is a good choice if you want to monitor your finances with minimal effort, and its premium version offers even more automation features for saving. However, it’s best for casual budgeters and those new to budgeting.

We’d recommend trying the free service for a few weeks before you use the 7-day free trial so you can compare and decide if the premium version is valuable enough for your needs and budgeting style.

*$2.5 billion in savings represents savings from bill negotiations after fees, subscription cancellations on an annualized basis, and deposits in smart savings. The total represents a gross figure and may not reflect the net savings of individual members. This calculation is based on internal data and has not been independently verified.