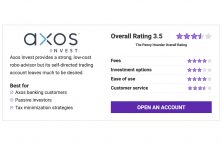

Axos Invest Review 2022: Pros and Cons

- Axos banking customers

- Passive investors

- Tax minimization strategies

In 2019, Axos Financial, a large nationwide financial institution, acquired WiseBanyan, Inc., a robo-advisor platform.

Axos Financial rebranded WiseBanyan as Axos Invest in October 2019. Building on its managed portfolios platform, Axos Invest launched self-directed trading accounts in 2021.

Axos Invest gives users two ways to invest their money: A passively managed portfolio or a self-directed trading account.

Managed Portfolios is Axos’ robo-advisor option. It creates a diversified portfolio for you based on your risk tolerance and financial goals.

It also gives you the option to tweak investments inside your portfolio if you disagree with the computer algorithm.

Managed portfolios carry a flat advisory fee of 0.24% per year and require a $500 minimum deposit to start investing.

If you’re a hands-on investor comfortable placing your own trades, Axos Invest also offers self-directed accounts. There’s no annual advisory fees or account minimums for self-directed accounts.

However, there are a few other account fees to look out for (we’ll dig into those shortly).

Not many investment platforms offer both a robo-advisor and a full self-directed trading platform. In our Axos Invest review, we break down the features and fees for both so you can make the best decision for your investing needs.

Axos Invest Review: Services and Features

| Feature | Details | More Details | ||

|---|---|---|---|---|

Account minimum |

$0/self-directed account |

$500/Managed Portfolios |

||

Account management fee |

0.24% |

n/a |

||

Account types |

Individual brokerage |

Roth, traditional IRAs |

||

Robo-advisor option? |

Yes |

n/a |

||

Self-directed trading option? |

Yes |

n/a |

||

Investment choices |

Stocks, bonds, options |

ETFs, mutual funds |

||

Automatic rebalancing? |

Yes |

Free |

||

Tax-loss harvesting |

Yes |

n/a |

||

Educational resources |

Not a lot |

More for Axos Elite |

||

Advanced trading tools? |

Few |

n/a |

||

Access to a financial advisor? |

No |

n/a |

||

Bank account/cash management account |

None |

Available from Axos Bank |

||

Customer service |

1-888-502-2967 |

[email protected] |

Axos Managed Portfolios Review

Axos Managed Portfolios is a robo-advisor that takes the guesswork out of investing.

You’ll start by answering a few questions about your risk tolerance, income and financial goals.

Axos Core Portfolios are composed of exchange-traded funds (ETFs), weighted to reflect the amount of risk you’re willing to take.

You can set multiple goals within the app. You can save toward major life events like retirement, a new home, a wedding and more. You can also adjust and change your goals over time.

Axos Invest is unique because its Managed Portfolios allow more customization than many other robo-advisors.

You can build Custom Portfolios or select from a handful of pre-built Featured Portfolios.

You can add or remove investment types (such as stock vs bond ETFs) as well as add investments by sector, such as health care or technology.

Account Types

There are three different account types available with Managed Portfolios:

- Individual personal investment accounts

- Traditional IRAs

- Roth IRAs

Account Minimum and Management Fees

While it’s free to open an Axos managed portfolio account, you’ll need a minimum account balance of $500 to start investing.

Axos Invest charges an annual 0.24% advisory fee on your investment portfolio balance. This is nearly identical to other robo-advisors, like Wealthfront and Betterment, which both charge 0.25% advisory fees.

If your account balance drops below $500 by the end of the month, Axos Invest will charge you a $1 monthly fee.

Here are some other fees to be aware of:

- ETF expense ratios: All exchange traded funds (ETFs) come with built-in expense ratios. The average expense ratio on Axos Invest is around 0.12%. This fee is charged by the fund itself, not by Axos.

- IRA closeout fee: There’s a $50 fee to close out an Axos Invest IRA. According to the company’s website, Axos Clearing may also charge closing or transfer fees.

- IRA transfer fee: $75 to transfer your IRA somewhere else (or to transfer a traditional IRA to a Roth IRA). This fee is pretty standard among

- IRA annual custodial fee: $40. This management fee is unusual for the robo-advisors we’ve reviewed. Betterment, for example, doesn’t charge this type of annual management fee.

You can see a full list of Axos Invest fees on the company’s website.

Investment Choices

Like many robo-advisors, Axos Invest Managed Portfolios give you a single investment option: Exchange traded funds (ETFs).

ETFs are passively managed, trade like stocks and usually track a certain index, like the S&P 500.

Because they hold multiple securities in a single share, they help provide instant diversification to your portfolio. Instead of hand-picking numerous stocks or bonds, an ETF bundles the biggest companies together into a single fund.

Like most robo-advisors, Axos Invest follows Modern Portfolio Theory, an investment strategy that aims to reduce your risk and increase your investment gains by spreading securities across different asset classes.

ETFs options for Axos Invest managed portfolios include:

- U.S., international and emerging market equities

- U.S. government and corporate bonds

- Short-term high-yield bonds

- Treasury inflation-protected securities

- Real estate investment trusts (REITs)

Many of the ETFs on Axos Invest are from Vanguard and iShares.

Automatic Rebalancing

Axos Invest users get free automatic rebalancing on all managed investment portfolios.

Axos will rebalance your investment portfolio when your asset allocation drifts 5% or more from its target allocation.

Rebalancing means the company adjusts the securities in your portfolio so they match the allocation you originally selected.

Tax-Loss Harvesting

Managed Portfolios also benefit from automatic tax-loss harvesting, a tax strategy which sells ETFs that have declined in value and replaces them with similar ETFs.

The goal is to use some of these losses to offset the cost of capital gains tax.

Axos Invest offers other tax minimization strategies, including selective trading.

Selective trading gives you the ability to restrict certain ETFs from your Managed Portfolio account in an effort to reduce the likelihood of creating wash sales, which can negate the losses realized by tax-loss harvesting.

Quick Deposit and Auto-Deposit Scheduler

Some investment apps take one to three days to process your deposits. Axos Invest’s quick deposit feature lets you invest any deposits on the same day or the next trading day.

The company’s auto-deposit scheduler lets you pick the specific day new funds are deposited into your account.

Self-Directed Account Review

If you want to pick your own investments, or explore more advanced features like options trading, an Axos Self-Directed Trading account might be a good choice.

These accounts don’t provide automatization or guidance like a robo-advisor. They’re best suited for active traders who know their way around the stock market.

However, the self-directed platform lags behind other online brokers — such as TD Ameritrade, E*TRADE and even Robinhood — which boast more low-cost features.

Axos Invest offers a premium account tier, called Axos Elite, which lets users access a few additional features for a $10 monthly fee.

Account Types

The account offerings for Managed Portfolios and self-directed accounts are similar.

The only difference? Self-directed traders can access joint brokerage accounts.

All available investment account types:

- Individual brokerage accounts

- Joint brokerage accounts

- Roth IRAs

- Traditional IRAs

Investment Choices

Self-directed accounts offer a wider selection of investment products than the Axos Invest robo-advisor.

You can trade:

- Stocks

- ETFs

- Mutual funds

- Options

- Margin trading (available to Axos Elite members)

However, Axos Invest lacks several investment types found on other self-directed platforms, including bonds, futures and cryptocurrency.

You can’t purchase fractional shares with a self-directed account either.

Account Minimum and Fees

There’s no required minimum deposit to open an Axos Invest self-directed account.

However, you’ll need a $50 minimum investment to open a self-directed IRA. (Many other online brokers offer IRAs with no account minimum.)

Axos Invest offers $0 commission-free trading on stocks and ETFs. This is standard for most trading platforms nowadays.

However, there are other account fees you should be aware of, including:

- Options trades: $1 per contract

- No-load mutual funds: $9.95 per trade

- IRA closeout fee: $50

- IRA transfer fee: $75

- IRA annual custodial fee: $40.

Axos Invest offers over 10,000 mutual funds but the $9.95 fee per trade is quite high when you consider other platforms don’t charge any transaction fees.

The company also lacks low-cost mutual funds, which generally carry fund fees less than 0.5%.

Axos Elite

Self-directed account customers can opt into a premium tier subscription, called Axos Elite, for $10 a month.

According to the company’s website, Axos Elite gives you access to an “advanced variety of investment instruments and enhanced personalization.”

What that boils down to is:

- Real-time market data and TipRank research: TipRanks is a third-party provider that collects analysts’ insights and recommendations.

- Extended trading hours: You can trade from 4 a.m. to 7 p.m. ET instead of the normal stock market trading hours of 9:30 a.m. to 4 p.m.

- Margin trading: With a 5.5% interest rate.

The company claims that Axos Elite members benefit from discounted rates and fees — but we only found one difference. Instead of paying $1 per contract on options trades, Elite users pay $0.80.

A $0.20 per contract savings doesn’t justify the extra $10 Elite subscription fee in our eyes, especially when platforms like Webull offer $0 options trades to all users for free.

Axos Elite users can also apply for margin trading. Margin trading is a risky endeavor because you can lose much more than you invested. It’s best reserved for professional money managers and sophisticated investors.

But if you’re determined to trade on margin, Axos Elite charges an interest rate of 5.5%. The company calls this rate competitive — but it’s not the cheapest option out there: Robinhood charges a flat 2.5% interest rate for margin trading, and Webull’s interest rates start at 3.99%.

In our opinion, Axos Elite comes at a premium price without worthwhile premium benefits.

Mobile App

Axos offers two mobile apps:

- Axos Bank

- Axos Invest Managed Portfolios

From our research, you can’t create a new Axos Invest account on either mobile app. Instead, new users must sign-up on the Axos Invest website.

After that, you can download the Axos Bank app and login with your Axos Invest username and password.

You don’t need to open an Axos checking or savings account to use the mobile app.

Once you’re logged into the app, it’s easy to manage your investing account. You can check your balances, buy and trade stocks, view all your accounts, transfer funds and pay bills within the same app.

But the app isn’t perfect. You can’t purchase mutual funds for your self-directed account in the app, for example.

Educational Resources, Research and Market Data

Educational resources are scarce for both Axos Invest managed portfolios and self-directed accounts.

With a basic membership, investors only have access to the company’s blog, which includes posts on broad financial topics. But the platform doesn’t include robust educational videos, interactive tools or other features helpful to new investors.

Axos Invest also lacks discussion forums, tutorials and seminars.

You can only access real-time market data, research and third-party analytics with an Axos Elite account. We think traders should get access to some of this information for free, or at least pay a lower price for access.

Access to Human Advisors

Axos Invest doesn’t offer access to human financial advisors. If you’re looking for 1-on-1 personalized investment advice, look elsewhere.

Axos Banking Services

Axos Invest accounts don’t offer a savings account or cash management option. However, you can open a savings account with Axos Bank, its affiliate company.

Customer Service

We received a prompt reply from Axos Invest’s customer service team when we reached out with questions for our review.

However, we would be remiss not to mention some complaints we found online about the investing platform. Many involved issues with transferring assets to a new brokerage firm and receiving cost basis information. Others complained of slow response times from Axos.

Pros and Cons

Like all investing platforms, Axos Invest has its ups and downs. Here’s what we like — and dislike — about the company’s robo-advisor and self-directed trading platforms.

Pros and Cons About Managed Portfolios

Axos Managed Portfolios are competitive with other robo-advisors and offer low management fees. We think it’s the company’s strongest option.

Here’s where this platform shines, and where it can use some work.

Pros

- Low 0.24% annual advisory fee

- Tax-loss harvesting

- Automatic portfolio rebalancing

- Goal-based investment strategy

- Diversified ETF portfolios tailored to your personal risk score

- Excellent mobile app

- Customizable portfolios

- Customizable portfolios

Cons

- $500 account minimum balance

- $40 annual custodial fee for IRAs

Pros and Cons About Self-Directed Portfolios

Axos Self-Directed Trading account honestly leaves a lot to be desired.

Since the company just launched self-directed accounts in 2021, we hope its features and offerings improve over time.

Pros

- No trading fees on stocks and ETFs

- $0 required minimum to open an account

Cons

- No bonds

- $50 minimum to open an IRA

- $40 annual custodial fee for IRAs

- $9.95 per mutual fund trading fee with few low-cost mutual fund options available

- No fractional shares

- $1 per options contract fee (that’s higher than several other self-directed platforms)

- Axos Elite offers few benefits for its hefty $10 per month ($120 per year) price tag

- Limited educational resources for basic accounts

Rachel Christian is a Certified Educator in Personal Finance and a senior writer for The Penny Hoarder.